How to Identify Parallel Trade Licenses in the EU: A Guide for MA Holders

Parallel trade, also known as parallel import or parallel distribution, is a reality for every Marketing Authorisation Holder (MAH) operating in the European pharmaceutical market. While legal under EU free movement laws, parallel trade introduces commercial and regulatory complexity, particularly for originator companies. One of the most frequent challenges we hear from MAHs: "Where can we find out where our products are being parallel traded?"

The short answer: there is no single, confirmed source for this data. The more useful answer: if you know where to look, you can start to piece together the picture.

What Is a Parallel Trade License?

A Parallel Trade License (PTL) is a national-level authorization that permits a company, usually a licensed wholesaler or parallel importer, to import and distribute a medicine in a given EU country, even if the product is already marketed there by the originator.

These licenses rely on the existence of an original Marketing Authorisation (MA), and the product must be essentially similar. The license process differs between EU countries, but the underlying principle is consistent: if a medicine is legally available in one EU country, it can, in principle, be imported and resold in another.

Why MA Holders Want This Information

MAHs want visibility into parallel trade activity for several reasons:

- Regulatory risk management – Ensuring product presentation, labeling, and safety information are not compromised.

- Market dynamics – Understanding where their products are being re-imported helps inform commercial strategy.

- Price pressure signals – PTLs often emerge where price differentials between EU markets are greatest.

- Brand protection – Identifying potential misuses of packaging or branding in secondary markets.

Where to Find Parallel Trade License Information

While no central database lists all parallel trade activity, there are multiple fragmented sources MAHs can use:

National Regulatory Authority Websites

EMA Notifications

- For centrally authorised products, the EMA publishes notices of parallel distribution approvals. These are limited but can be useful for specific product lines.

Medicinal Product Registers

- Some countries include parallel import entries in their general product databases. Searching by product name can uncover these.

Commercial Intelligence Tools

- Platforms like PharmaFootpath consolidate fragmented public and semi-public records to give MAHs visibility across Europe—saving hours of regulatory digging.

What You Can (and Can't) Learn

From available records, MAHs can typically learn:

- Destination markets – Where the license has been granted.

- Product identity – Name, strength, form, and pack size.

- MA reference – The original MA it references.

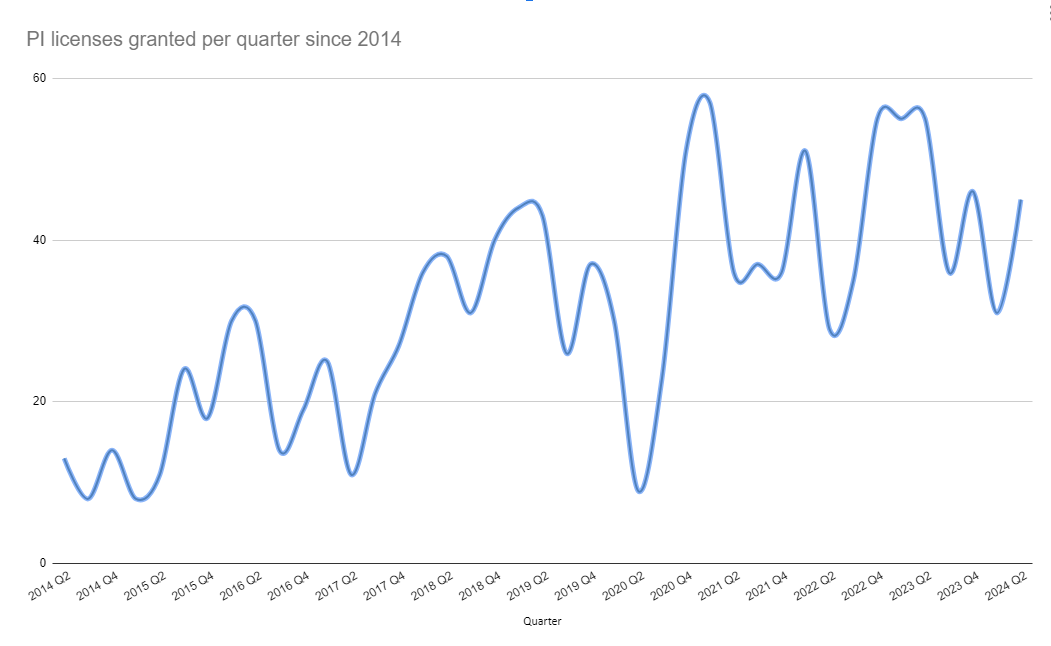

- Date of issuance – Timing can be useful to map trade activity trends.

- Origin market - Only for national registrations, in most markets.

However, most sources do not disclose:

- The name of the exporting wholesaler or trader

- The name of the importing wholesaler or trader

Still, by comparing issuance patterns across markets and dates, companies can infer probable source countries—particularly when cross-referenced with price trends and trade flows.

Variations in Terminology

When researching or setting up alerts, keep in mind that regulators and companies may use different terms:

- Parallel Trade

- Parallel Import

- Parallel Distribution

The terms are often used interchangeably, but some agencies differentiate them based on the authorisation route.

Final Thoughts

For MAHs, the lack of a single source of truth on parallel trade licenses can be frustrating. But the data is out there it just takes the right tools and methodology to extract it.

If you're a Marketing Authorisation Holder looking to monitor how and where your products are being parallel traded, PharmaFootpath offers a consolidated intelligence solution built specifically for the nuances of EU pharmaceutical trade.

Want to see where your products are showing up in parallel trade? Book a call with PharmaFootpath to have a more detailed conversation about how other MA Holders use our data to investigate parallel trade data.